how to calculate taxes taken out of paycheck in illinois

Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding. How much is 90k after taxes in Illinois.

Illinois Payroll Tax Guide 2022 Cavu Hcm

Use this tool to.

. The calculators on this website are provided by Symmetry Software and are designed to. It can also be used to help fill steps 3 and 4 of a W-4 form. See how your refund take-home pay or tax due are affected by withholding amount.

How Your Paycheck Works. Personal income tax in Illinois is a flat 495 for 2022. Take your hourly salary 15 and multiply by 8 hours worked per day.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. How do I figure out the percentage of taxes. State Date State Illinois.

But calculating your weekly take-home. How do you calculate income after taxes. According to the Illinois Department of Revenue all incomes are created.

Just enter the wages tax withholdings and. The jackpot for Powerballs Monday night drawing is a whopping 1 billion. You can even use historical tax years to figure out your total salary.

How It Works. Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. How much taxes is taken out of a paycheck in Illinois.

The Illinois Paycheck Calculator uses Illinois tax tables and Federal Income Tax Rates for 2022. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois. For example if an employee earns 1500 per week the individuals.

The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings. Switch to Illinois hourly calculator. The 2023 Tax Calculator uses the 2023 Federal Tax Tables and 2023 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

The advertised number represents the pretax amount youd get if you were to receive. Well do the math for youall you need to do is enter the. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

Change state Check Date General Gross Pay Gross Pay Method Gross Pay YTD Pay Frequency Use 2020 W4 Federal Filing. Supports hourly salary income and multiple pay frequencies. To calculate your daily pay.

The Illinois paycheck calculator will calculate the amount of taxes taken out of your paycheck. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. What percentage of my paycheck is withheld for federal tax 2021.

Personal income tax in Illinois is a flat 495 for 20221. How much is 75k after taxes in Illinois. Estimate your federal income tax withholding.

Youll pay no tax on the first.

New Tax Law Take Home Pay Calculator For 75 000 Salary

No Illinois Does Not Send More To Federal Government Than It Gets Back Wirepoints Wirepoints

Tax Filing Without The Headaches Illinois Earned Income Tax Credit Simplified Filing Pilot

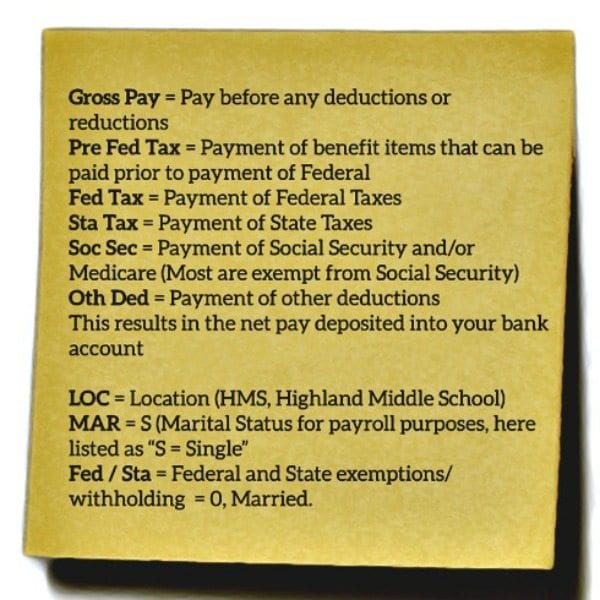

Understanding Your Teacher Paycheck We Are Teachers

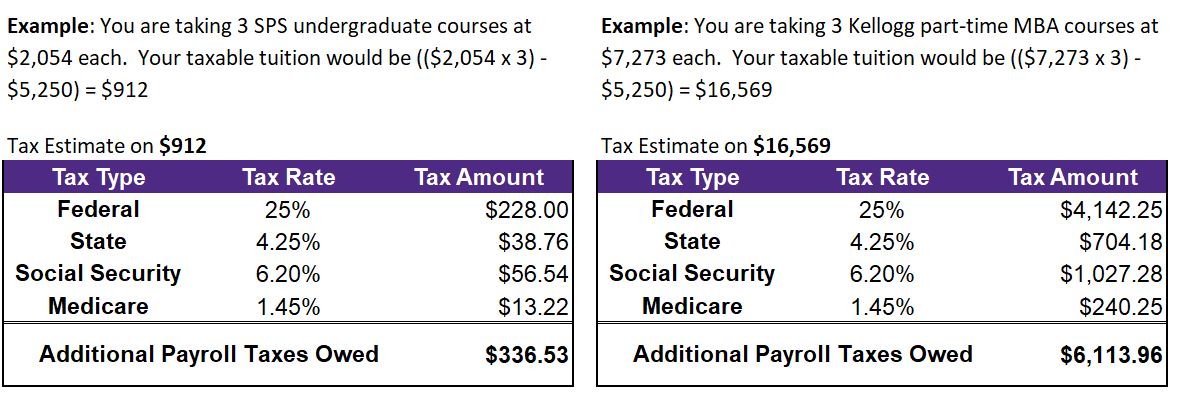

Tuition Taxation Human Resources Northwestern University

Illinois State Taxes Everything You Need To Know Gobankingrates

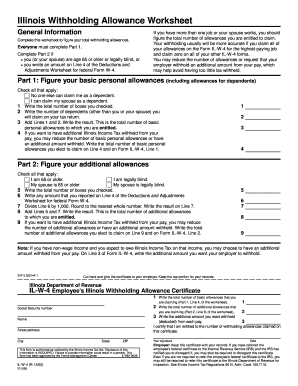

Illinois Withholding Allowance Worksheet Example Fill Online Printable Fillable Blank Pdffiller

Illinois Retirement Tax Friendliness Smartasset

State W 4 Form Detailed Withholding Forms By State Chart

Paycheck Tax Withholding Calculator For W 4 Tax Planning

How To Calculate Child Support In Illinois With Pictures

Illinois Payroll Tools Tax Rates And Resources Paycheckcity

Illinois Payroll Tax Guide 2022 Cavu Hcm

How To Calculate Illinois Income Tax Withholdings

Taxes 5 1 Taxes And Your Paycheck Payroll Taxes Based On Earnings Paid To Government By You And Employer Income Taxes You Pay On Income You Receive Ppt Download

Self Employed Determine Your Ideal Hourly Daily Rate Morningstar

Illinois Paycheck Calculator Adp